petekarici/E+ via Getty Images

This article was coproduced with Nicholas Ward.

In recent days, we’ve seen significant selloffs occur in the retail space.

There’s no doubt that rising inflation is hurting profit margins. This has led to earnings per share (EPS) misses, disappointing margins, and poor forward guidance.

Target (TGT), for one, dropped more than 30% during the two-day aftermath of its Q1 earnings report. Walmart (WMT) shares fell nearly 20% during the last week, after having missed on the bottom-line and posted disappointing earnings guidance.

Williams-Sonoma (WSM) is down approximately 9% since it reported. And, as we wrote this, Ross Stores (ROST) was down nearly 25% afterhours due to more poor guidance.

This list of disappointments could go on and on.

Now, best-in-breed home improvement players Lowe’s (LOW) and Home Depot (HD) were faring fairly well. They were down only 2% or so during the last five trading sessions (as of Thursday evening).

But both still mentioned inflationary headwinds. And their relatively stronger margins insinuated a disconnect between affluent and not-so-affluent consumers.

While the former can certainly handle inflation better, discretionary spending is seeing macro pressure. And this will hurt every retailer somehow, someway.

Understanding The Inflationary Environment We’re In (As Much As We Can)

It’s unclear when inflation will abate. We’ve been seeing very hawkish commentary coming from Fed officials, after all.

This might provide solace to those panicking over rising costs. But don’t forget that the broader economy will suffer for it, potentially even going into a recession.

Therefore, it might be a damned if they do, damned if they don’t type of scenario here.

So, what does all of this mean for investors?

Well, a lot of things, frankly. But breaking down the macro environment here would turn this report into a novel. Therefore, what we want to do is first take a closer look at the shopping-center real estate investment trust (REIT) space.

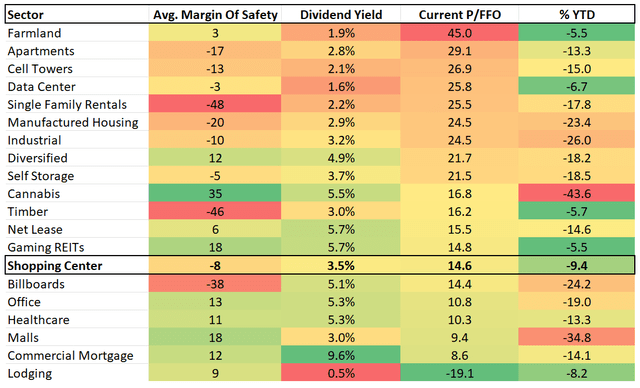

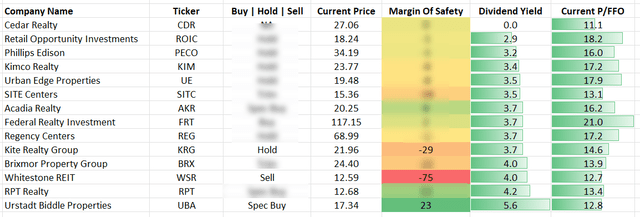

(iREIT on Alpha)

Struggling tenants could put pressure on leasing demand or even rent collection. However, fearful sentiment in the market often pushes share prices down to irrationally cheap levels, creating attractive bargains for long-term investors.

Even so, we won’t be discussing the highest-quality, most widely owned and/or followed names in the space today. We’re bypassing stocks like Federal Realty Trust (FRT), Regency Centers (REG), and Kimco (KIM) this time around.

Instead, we’ll take a look at three relatively under-covered REITs to better understand the subsector in general.

Whitestone REIT

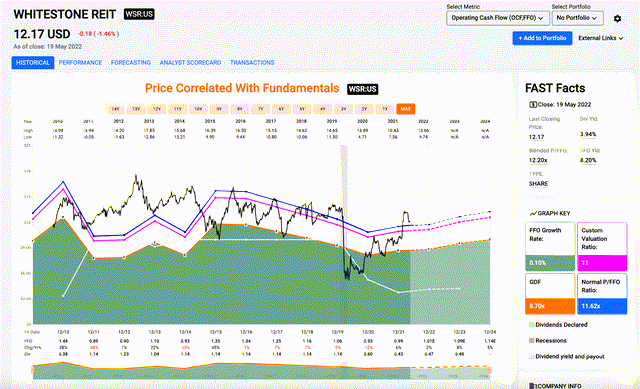

In early May, the Sunbelt community-centered Whitestone REIT (WSR) posted Q1 results that beat analyst estimates. Revenue, for one, totaled $34.12 million, up 17.5% on a year-over-year basis.

WSR’s funds from operations (FFO) were $0.30 per share, $0.05 better than expected. This represented 50% growth relative to 2021’s Q1 FFO result of $0.20/share.

And same-store net operating income (NOI) was $22.3 million versus $19.8 million, representing 12.9% growth. It must have been anticipation of such good news that had WSR announce a dividend hike for Q2: up 11.6% quarter-over-quarter to $0.12

As for full-year guidance, management reaffirmed its previous figures, estimating that net income will be $0.35-$0.39 per diluted share. And it expects FFO in the $0.98-$1.02 range per diluted share and operating partnership unit.

All good news, everything considered!

Just not good enough since that latter expectation only means low single-digit year-over-year growth – at best — when 2021’s full-year FFO figure was $0.99. And the company’s 2019 result was $1.06.

So while Whitestone REIT is recovering, it will likely take five years or more for the stock to return to its FFO highs in 2016. And that dividend it just raised? That’s going to take time recovering too after everything it lost during the shutdowns.

WSR currently trades with a blended p/FFO multiple of 12.2x – which is above its long-term historical average of 11.62x. And we don’t see enough justification to pay an outsized premium for shares.

(Source: FAST Graphs)

Our Buy Below threshold is just $5 largely due to its mere 11/100 iREIT iQ (quality) score – the lowest in the entire shopping-center subset. In today’s volatile environment, we want stronger stock than that.

That’s why Whitestone REIT receives a “Sell” rating here. Frankly, we see a myriad of better places to be allocating capital right now.

Let’s Go Fly A Kite Realty Group – But Only if We Already Own It

Moving away from sells into “hold territory,” we want to highlight Kite Realty Group (KRG) with its collection of neighborhood, community, and lifestyle centers.

On May 11, KRG announced a 5% quarterly dividend increase from $0.20 to $0.21. However, as with WSR, it will still likely be a while before shareholders are made whole posy-shutdowns.

We like to see payments trending in the right direction, but it’s difficult to be ecstatic about this slow recovery.

Speaking of recovery, KRG posted its Q1 results on April 28, beating on both the top and bottom lines. Revenue totaled $194.39 million, up 180.2% year-over-year and $11.23 million above estimates.

FFO per share, meanwhile, was $0.46, up 35% and $0.04 better than expected. And same-property NOI rose 5.9%.

Furthermore, operating retail portfolio annualized base rent (ABR) per square foot was $19.57 as of March 31 – a 5.6% year-over-year increase.

KRG also updated its full-year FFO guidance from $1.69-$1.75 per diluted share to $1.74-$1.80. This was, as it said, “based in part on the following key assumptions:

- Increased same property NOI range to 2.25% to 3.25%, which represents a 75-basis point increase at the midpoint

- Decreased bad debt by 25 basis points to 1.25% of total revenues at the midpoint.

- Any transaction activity is expected to be earnings neutral.”

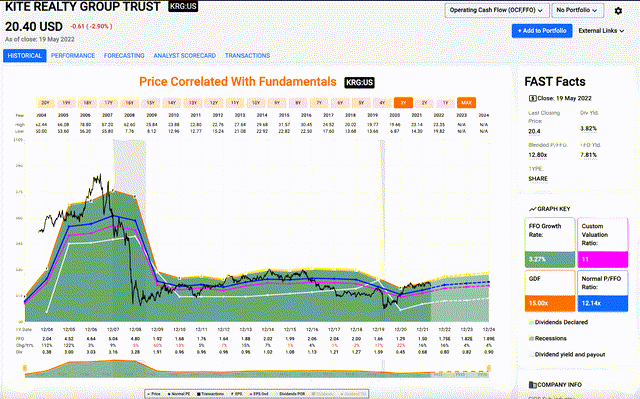

We love seeing raised full-year estimates. Assuming that management hits that, KRG’s 2022 bottom-line results will surprise its pre-pandemic levels.

Though it’s important to note that the current analyst consensus estimate of $1.75 is still lower than its 2018 print. And in 2016, KRG posted its recent peak FFO of $2.06.

Basically, KRG is fighting an uphill battle to regain a positive longer-term growth trajectory, like many of its peers. And, once again, this could take a decent five years.

Still, all in all, KRG’s balance sheet looks relatively strong.

During Q1, management highlighted a 5.7x net debt to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio. And KRG continues to maintain its BBB- investment grade rating.

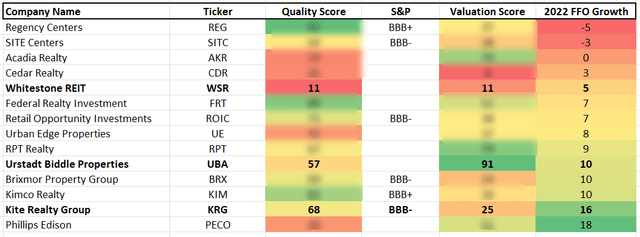

It might not be one of the highest-rated shopping-center REITs we track. But it’s 68/100 IQ score are above the 56 peer group average.

(Source: FAST Graphs)

Shares currently trade with a blended p/FFO multiple of 12.8x compared to its long-term average of 12.1x. Should it go down from there, we’d be interested in buying in.

iREIT’s Buy Below price is currently $17 though, meaning we’d need to see about a 20% pullback to see an attractive margin of safety.

We’ve Got A Buy In Urstadt Biddle Properties

Urstadt Biddle Properties (UBA) also recently posted Q1 results.

Its growth was a bit slower than its peers. However, because of its recent selloff and relatively cheaper valuation, we’re giving it a “Speculative Buy.”

It’s an intriguing value play for investors willing to stomach the risks associated with a relatively lower-quality holding.

UBA posted revenue of $35.55 million during Q1, up 3.7% year-over-year. And FFO was $0.33 per share in line with 2021’s Q1 result.

Other numbers include:

- Net income attributable to common stockholders of $5.4 million net income, or $0.14 per diluted share

- Same-property NOI of $1.4 million, up 6.1% year-over-year

- A gross leasable area (‘GLA’) that was 92.6% leased as of January 31, up 0.7%

- A 4.9% average decrease in base rental rates on new leases signed

- A 2.6% average increase in base rental rates on lease renewals signed.

Overall, we were relatively pleased with the growth figures highlighted above – and happy to see UBA’s Covid-19 impact update:

All 72 of our shopping centers, as well as all of our free-standing, net-leased retail bank branches and restaurant properties, are open and operating, with 99.6% of our total tenants based on… ABR… open and operating.

Plus, all its shopping centers include at least one “necessity-based” tenant. And 70.3% of those clients (based on ABR) being “essential businesses “or otherwise permitted to operate through curbside pickup and other modified operating procedures.”

Today, those “businesses are 99.8% open.” And:

94.8% of the total base rent, common area maintenance charges (CAM), and real estate taxes payable for the period of April 2020 through January 2022 has been paid.

Once again, we’re good with most of that.

Urstadt Biddle Continued…

As for Q1 specifically, Urstadt Biddle noted:

96.3% of the total base rent, CAM, and real estate taxes payable for the first quarter of fiscal 2022 has been paid.

All put together, it’s clear there are still some slight issues going on here. However, rent collection should continue to improve from here. So the relatively lower results represent intriguing upside potential.

The REIT has ample liquidity with $24.6 million of cash and cash equivalents on the balance sheet, plus a $124 million unsecured revolving credit facility. And no significant debt comes due until 2024.

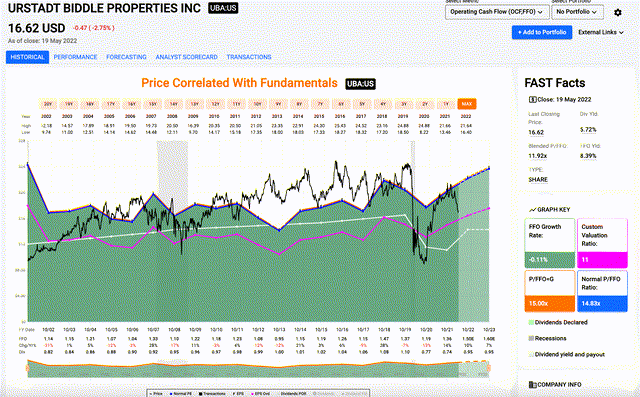

Shares are down nearly 23.3% from their 52-week highs and 9.38% during the last month alone – weakness that’s driven its blended p/FFO multiple down to 11.92x.

(Source: FAST Graphs)

That’s well below the company’s long-term 14.83x average.

It will take time for Urstadt to convince the market to pay nearly 15x FFO. However, analysts are calling for 10% FFO growth this year and 7% next year.

As such, it appears to have a long-term growth runway ahead of it with a relatively cheaper valuation.

UBA’s IQ rating is 57/100, putting it about average with its peers. However, with a sub-12x blended P/FFO multiple – and more importantly, 11x forward p/FFO – UBA’s iREIT iV (valuation) score is 89/100.

Shares are currently trading below iREIT’s Buy Below target of $22.50, giving about a 26% margin of safety at current levels.

No, this isn’t exactly a blue-chip stock after its recent performance. However, for a value-oriented investor who’s bullish on the shopping-center space…

UBA seems to offer one of the more intriguing price points in the industry, with the highest iREIT IV score of its peer group.

In Conclusion…

Keep in mind that Urstadt Biddle isn’t the only shopping center Buy we have at iREIT on Alpha. There are others we recommend, as our iREIT Tracking tool on iREIT on Alpha shows:

(iREIT on Alpha)

Our research is powered by data, analytics, and granular research. And we’re constantly looking to unlock value by careful examination of each security within our coverage spectrum.

That’s just how we operate: always looking for the best opportunities available.

(iREIT on Alpha)

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.