Bennett Raglin/Getty Images Entertainment

Shopify (NYSE:SHOP) has been on my watchlist for over a year now. The stock has cratered by 75% which made me very interested in the stock. With that said, here’s a deep dive on Shopify. Enjoy!

Investment Thesis

The company sold off many times over the last few months due to overvaluation, the slowdown in growth, a weak outlook, rising competitive threats, and a worsening global economy. After its valuation cut, the stock looks much more attractive, although we may see further downside in the short term.

Despite the risks, Shopify is a high-quality business with a long growth runway ahead in the e-commerce industry. It is building the internet infrastructure through its vertically-integrated platform that is growing stronger and stickier by the day. Furthermore, management is investing heavily back into the business, which should pay off in the long run.

As such, I will be looking for more drops to shop for.

Value Proposition

In a nutshell, Shopify is an all-in-one commerce platform solution that makes it wonderfully simple for people to start, run, and grow a business. The company’s founding came from humble roots as the idea blossomed when co-founders Tobi Lütke and Scott Lake attempted to open Snow Devil, an online store for snowboards. At that time, back in 2006, there were no tools that could allow them to easily start an online store from scratch. Thus, the snowboard enthusiasts, together with Daniel Weinand, decided to capitalize on this opportunity by building their own software solution – Shopify.

Mission: Making commerce better for everyone.

Source: Snow Devil

Shopify aims to build the internet infrastructure for commerce by simplifying the user experience for business owners to build their businesses and manage their brands.

Source: Shopify FY2021 Q4 Investor Presentation

Let’s take a look at some of Shopify’s products and services.

Online Store

Perhaps, the main reason why merchants visit Shopify is to set up their online store. Building a website is quite a complicated process which is where Shopify comes in – they want to make it stupid simple for all users, even for those non-tech-savvy ones.

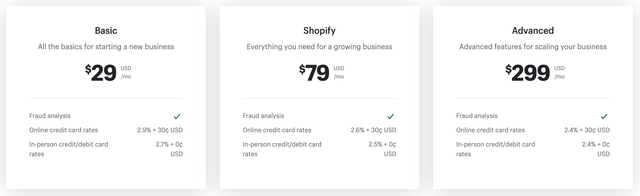

Shopify offers tiered subscription plans catered to varying business needs and sizes. In addition, Shopify also offers tools such as a business name generator, professional logo maker (Hatchful), buy and register domain names (Exchange), stock photos (Burst), order wholesale products (Handshake), and drag-and-drop pre-built themes (Shopify Themes).

Through the Shopify App Store, merchants can also choose a variety of in-house and third-party apps to integrate into their Shopify-powered websites, thereby enhancing the user experience based on each business type.

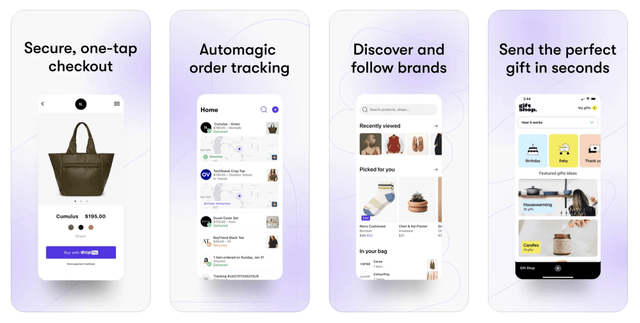

Speaking of apps, merchants can also list their products and services on Shopify’s consumer-facing mobile app, the Shop App. Consumers can use the app to track packages, discover products, and shop from a variety of brands. Merchants can also manage their Shopify businesses on the go with the Shopify Mobile App.

Source: App Store

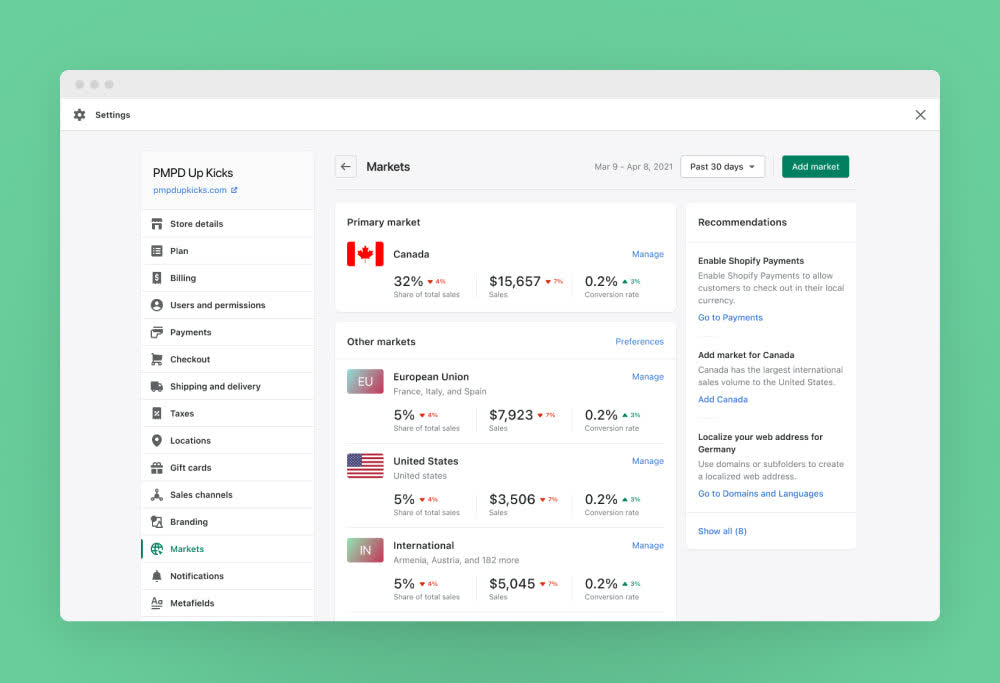

Shopify has also made it easier for merchants to expand internationally. Launched in September 2021, Shopify Markets streamlines the process for merchants to make cross-border commerce. Shopify Markets helps merchants set up storefronts in different languages, create international domains, and estimate and collect duties and import taxes. This is made possible through its partnership with Global-e (GLBE).

Source: Shopify Website

Payments

Included in Shopify’s main subscription plan is Shopify Payments, which is a payment processing service that enables merchants to accept payments, both online and offline. In addition, merchants can utilize Shop Pay, which is an accelerated checkout button that they can embed in the checkout page to maximize sale conversion. Furthermore, through its partnership with Affirm (AFRM), merchants can offer consumers Shop Pay Installments, an interest-free buy now pay later payment option.

For offline transactions, merchants can also opt-in for Shopify POS. This is a point-of-sale solution with fully-integrated software and hardware for merchants to process offline transactions.

Source: Shopify Website

Capital

Shopify Capital is a merchant cash advance and loan program for qualifying merchants. There are three types of funding available for merchants:

- Payroll funding to expand the workforce.

- Inventory funding for working capital, stock up for high seasons, and get bulk discounts.

- Marketing funding to increase brand awareness.

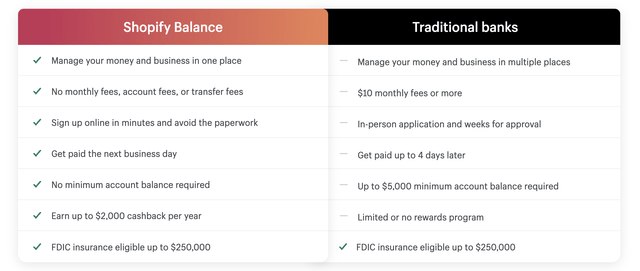

In addition, merchants can open a digital bank business account called Shopify Balance to manage their money efficiently. Shopify Balance is free of charge and it includes a card, cash back, and other perks for everyday business spending.

Source: Shopify Website

Marketing

Merchants can leverage Shopify’s library of third-party apps to integrate into their operations. For example, merchants can promote and sell their products on multiple sales channels including Google (GOOG) (GOOGL), Facebook (FB), TikTok, Walmart (WMT), eBay (EBAY), and more.

Among other things, merchants have access to a variety of marketing tools including SEO, Shopify Email, customer segmentation, custom marketing automation, and Shopify Inbox, which is a business chat app.

Inventory and Fulfillment

Shopify also has functions that simplify merchants’ operations. For example, Shopify offers merchant solutions such as smart inventory management, order management, and workflow automation (Shopify Flow). Merchants can also easily buy and print shipping labels and track orders through Shopify Shipping.

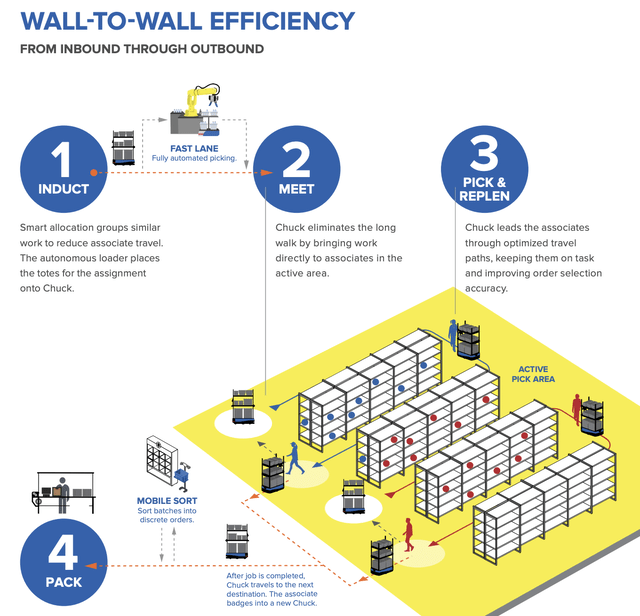

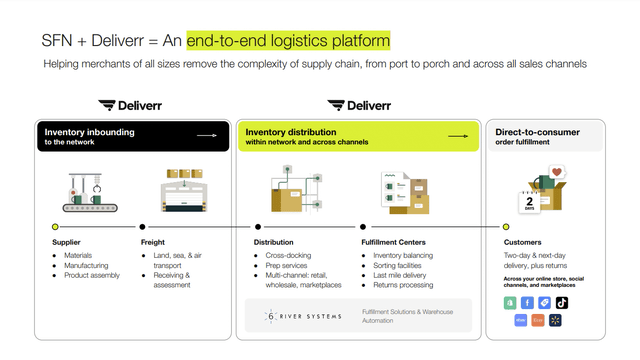

Launched in 2019, Shopify Fulfillment Network offers merchants order fulfillment services through its smart warehouses. Additionally, the company acquired 6 River Systems – which is a warehouse fulfillment and automation solutions provider – as the company begins to ramp up its efforts to fulfill the last-mile logistics and inventory management aspects of a merchant’s operation.

Source: 6 River Systems

Furthermore, Shopify has also announced its intended acquisition of Deliverr, an asset-light fulfillment technology provider. Here’s what it means for Shopify Fulfillment Network, as highlighted by the company in its recent earnings release:

Deliverr’s asset-light infrastructure complements and extends the reach of Shopify’s network of large-capacity, self operated hubs, and enhances affordable access to a two-day delivery promise in the U.S. across all channels. With Deliverr, Shopify strengthens its ability to offer merchants simplified inventory management, demand-driven inventory balancing, and fast delivery from coast to coast, with minimal inventory required.

Source: Shopify FY2022 Q1 Investor Presentation

In other words, the acquisition will accelerate Shopify’s ability to offer merchants an end-to-end logistics and fulfillment platform across all sales channels for merchants on and off the Shopify platform.

Education

Lastly, Shopify provides resources to educate and empower merchants because merchants who win mean Shopify wins as well. Here are some educational resources provided by the company:

- Blog

- Shopify Learn (business courses)

- Podcasts (Masters and Vanguard)

- Business encyclopedia

- Research reports

- Shopify Community

- Shopify Partner Academy

- Shopify Plus Academy

To summarize, Shopify provides businesses with an end-to-end cloud-based infrastructure solution that supports a multi-channel frontend as well as a single integrated backend. With Shopify’s offerings, merchants have full brand ownership throughout the entire commerce value chain.

Market Opportunity

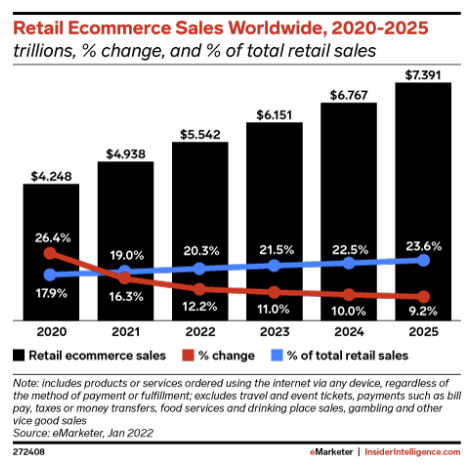

Shopify operates in the e-commerce industry and we’re already aware that e-commerce will likely continue to grow and make up a larger portion of total global commerce. According to Insider Intelligence, in 2021, e-commerce sales reached $4.9 trillion, which is about 19% of total retail sales. By 2025, e-commerce sales are expected to surpass the $7 trillion mark, representing 24% of total retail sales. Despite the slowing growth, e-commerce will likely continue to grow, taking market share from brick-and-mortar sales in the process.

Source: Insider Intelligence

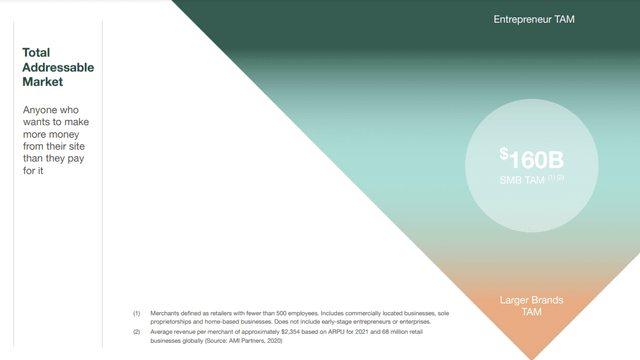

Shopify estimated that its TAM is about $160 billion. The company adopts a land-and-expand strategy where most SMBs first begin using the platform through its Basic subscription plan. As merchants grow and get more comfortable with the platform, they may opt for more advanced features that are only available if they upgrade their subscription plans (Shopify, Advanced Shopify, or Shopify Plus). With a TTM Revenue of $4.8 billion, Shopify is just getting started.

Source: Shopify FY2021 Q4 Investor Presentation)

Furthermore, as mentioned in my Pinterest (PINS) deep dive, social media e-commerce is expected to take off:

According to Accenture, social commerce is expected to grow 3x faster than traditional e-commerce, from $492 billion in 2021 to $1.2 trillion by 2025, growing at a CAGR of 26%. One caveat, though. China, which has a more mature market, will contribute the bulk of this figure. As for the US, social commerce sales are expected to reach more than double to $99 billion by 2025.

Shopify has integrations with social media channels like Facebook, Instagram, TikTok, Pinterest, and Snapchat (SNAP). As these social media companies add more shoppable features to their platforms, merchants will enjoy increased traffic, conversion, and sales, which, therefore, flows into Shopify’s top line.

All in all, we are still in the early stages of the e-commerce revolution and the growth of the industry will be a massive tailwind for Shopify.

Business Model

Shopify has two revenue streams: Subscription Solutions and Merchant Solutions.

Subscription Solutions

As the name implies, this segment is subscription-based and is predominantly recurring in nature – the company generates revenue through the sale of subscriptions to its platform and its POS Pro offering.

Source: Shopify Website

Shopify also generates Subscription Solutions Revenue through variable platform fees as well as the sale of separately priced themes, apps, and domain names.

Merchant Solutions

On the other hand, this segment is usage-based where higher Revenue is recognized as the company processes higher payment and order volumes.

Merchant Solutions Revenue is predominantly made up of payment processing fees and currency conversion fees from Shopify Payments. Here are the credit/debit card rates charged by Shopify:

Source: Shopify Website

In addition, this segment also consists of revenue from:

- Shopify App Store – clicks on the advertised app

- Shopify Capital – loan remittances and interest

- Shop Pay Installments – transaction fees

- Shopify Balance – transaction fees

- Shopify Shipping – sale of shipping labels

- Shopify Fulfillment Network – storage, picking, packaging, preparing, and shipping service fees

- Shopify POS Hardware – sale of hardware

- Shopify Email – based on the volume of emails sent

- Shopify Markets – duties, import taxes, currency conversion, and international payment processing fees

Growth

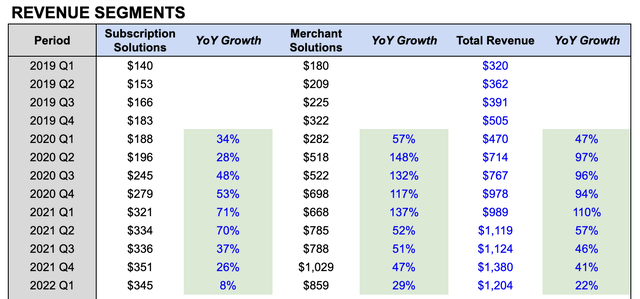

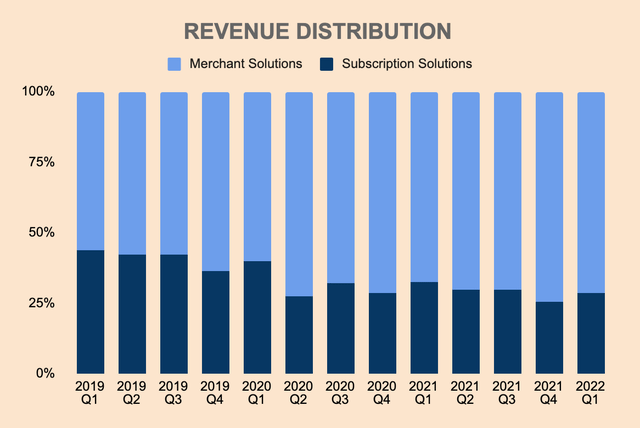

As a result of the pandemic, years of growth have been pulled forward to just one year. As seen in the table below, revenue growth spiked by 90%+ for four consecutive quarters from FY2020 Q2 to FY2021 Q1. Since then, growth rates have stabilized to a more normal cadence.

In its latest quarter, Total Revenue was $1.2 billion. The sharp deceleration to just 22% YoY growth in Q1 is a concern for many investors but this is expected since Shopify is a much larger company today, faced with very tough YoY comps.

Source: Shopify Investor Relations and Author’s Analysis

I’ve also broken down Total Revenue into Shopify’s two reportable segments: Subscription Solutions (SS) and Merchant Solutions (MS). One thing to take note of is that SS Revenue grew much slower than MS Revenue. This is because SS Revenue is recognized ratably over the contractual period of the subscription agreement (monthly, annually, or multi-year), while MS Revenue is usage-based and most of them are recognized upfront. As such, SS Revenue is a much more predictable segment while MS Revenue, despite its explosive growth, garners extra volatility. Here, we can see the evolution of Revenue distribution for each of the two segments.

Source: Shopify Investor Relations and Author’s Analysis

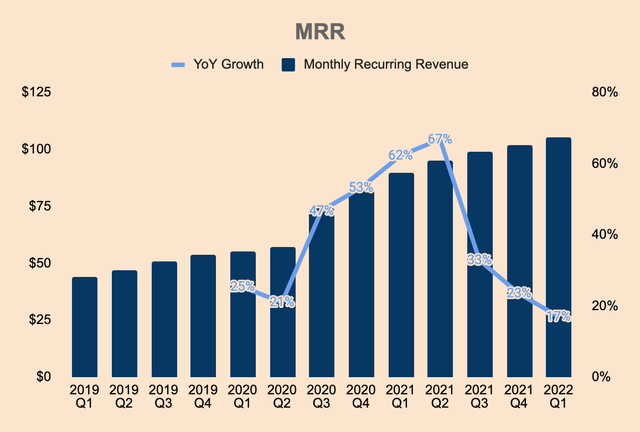

SS Revenue grew by only 8% YoY in Q1, to $345 million. The growth in SS Revenue was primarily due to the growth of Monthly Recurring Revenue, or MRR, driven by Shopify’s expanding merchant base, which was fueled by its extended free trial offering during the early days of the pandemic. MRR grew by 17% YoY in Q1, to $105 million. This was offset by the change in the Revenue sharing agreement with developers to incentivize them to sell apps and themes on Shopify’s platform, which was initiated in late Q2 last year.

Source: Shopify Investor Relations and Author’s Analysis

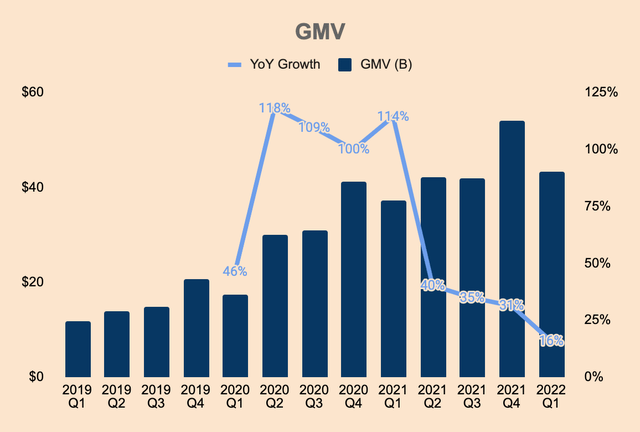

As for MS Revenue, the segment grew by 29% YoY in Q1, to $859 million. Strong growth over the last few quarters was due to higher Gross Merchandise Value, or GMV, facilitated through Shopify’s platform – MS Revenue is directly correlated with GMV. Higher GMV means that merchants use more MS services such as Shopify payments, Shopify Shipping, and Shopify Email, which translates to higher MS Revenue.

In Q1, GMV grew by 16% YoY, to $43 billion. Again, not close to the kind of growth rates that we’ve seen over the last few quarters.

Source: Shopify Investor Relations and Author’s Analysis

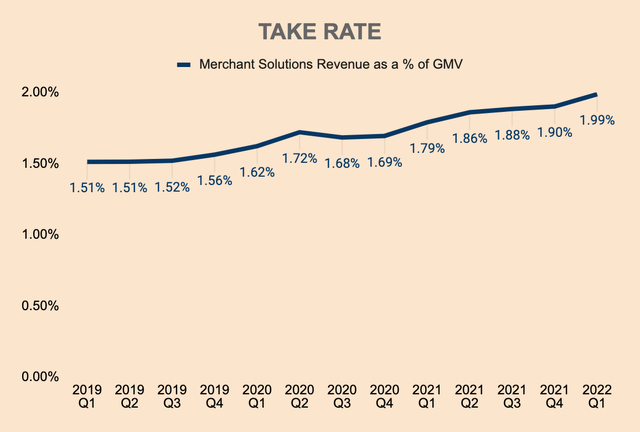

Notice that MS Revenue grew faster than GMV. This is due to Shopify’s higher take rate, as shown by its rising MS Revenue as a % of GMV. This shows that merchants are adopting more products and services on Shopify’s platform. Additionally, a 1.99% take rate is very low, which means that Shopify has ample room for growth in terms of monetization.

Source: Shopify Investor Relations and Author’s Analysis

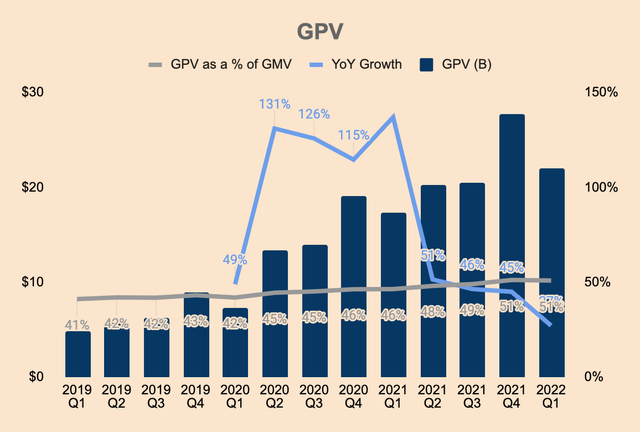

Shopify Payments makes up the bulk of MS Revenue. Consequently, MS Revenue growth was fueled by a higher number of merchants adopting Shopify Payments. Gross Payment Volume, or GPV, processed through Shopify Payments was $22 billion, up 27% YoY. GPV as a % of GMV has been consistently growing, at 51% as of the latest quarter. The higher Shopify Payments penetration rate is encouraging to see because Shopify Payments has higher transaction fees compared to transactions not using Shopify Payments.

Source: Shopify Investor Relations and Author’s Analysis

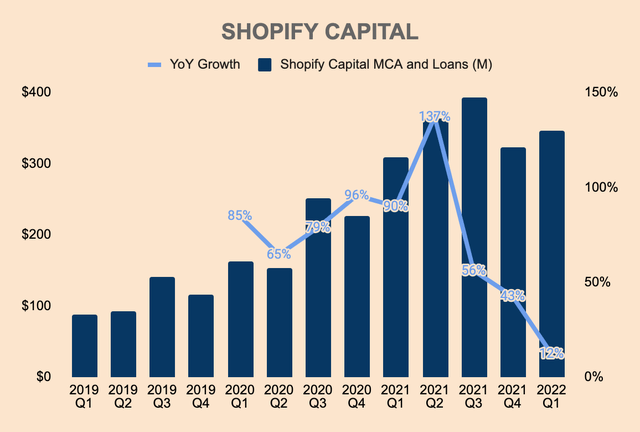

Merchant cash advances and loans provided by Shopify Capital, which is a part of MS Revenue, increased 12% YoY, to $347 million. Shopify Capital is considered one of the higher-margin services in Shopify’s product line.

Source: Shopify Investor Relations and Author’s Analysis

All in all, despite slowing growth rates, Shopify’s growth story remains intact as the company is well-positioned to onboard more merchants as well as process higher payment volumes in the ever-expanding e-commerce industry.

Profitability

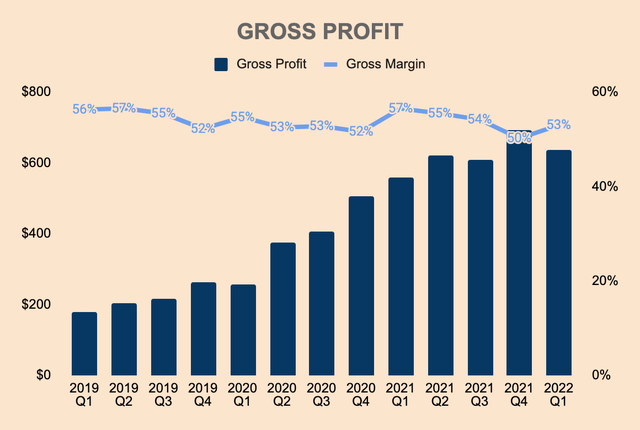

Turning to the company’s profitability, Shopify recorded $638 million of Gross Profit in Q1, 14 X% YoY. Gross Margin stands at 53%, which shows great earnings potential.

Source: Shopify Investor Relations and Author’s Analysis

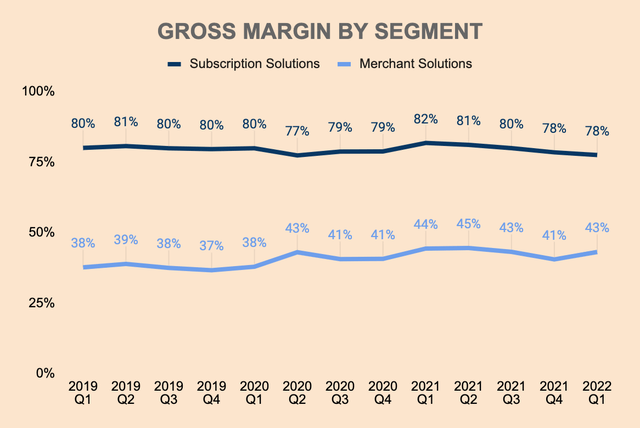

However, Gross Margin was lower than last year’s figure of 57%. The drop in Gross Margin is due to MS Revenue making a larger portion of Total Revenue. As you can see below, MS has a much lower Gross Margin profile than SS as MS includes services like Shopify Fulfillment Network, POS hardware, and Shopify Payments, which have more capital-intensive business models compared to the SaaS-nature of SS.

It is also worth noting that these margins look very stable so it should give some assurances to investors.

Source: Shopify Investor Relations and Author’s Analysis

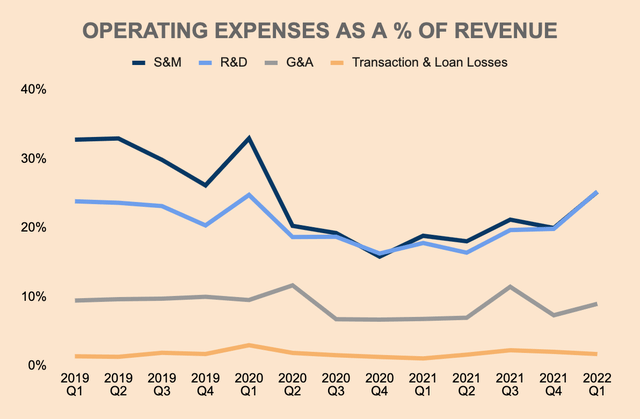

Operating Expenses were $736 million in Q1, up by a whopping 67% YoY. Below, you can see the different components of Operating Expenses as a % of Revenue, with Sales & Marketing and Research & Development being the larger portions of Operating Expenses. We can see that market awareness and product innovation are priorities for management.

Source: Shopify Investor Relations and Author’s Analysis

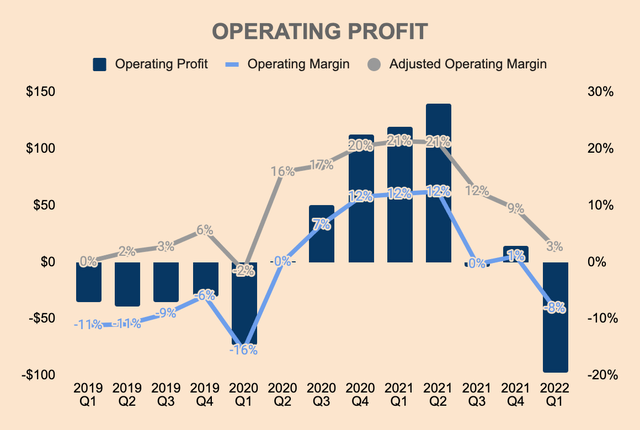

GAAP Operating Profit was $(98) million in Q1. Non-GAAP Operating Profit was $32 million in Q1, up only 3% YoY. As you can see, Operating Margins have been contracting over the last few quarters. This is due to the company ramping up investments in terms of hiring engineering and commercial talent as the company focuses on four critical investments:

- Launching new products and enhancing existing ones

- Enabling cross-border commerce

- Landing and expanding merchants

- Expanding Shopify Fulfillment Network

Source: Shopify Investor Relations and Author’s Analysis

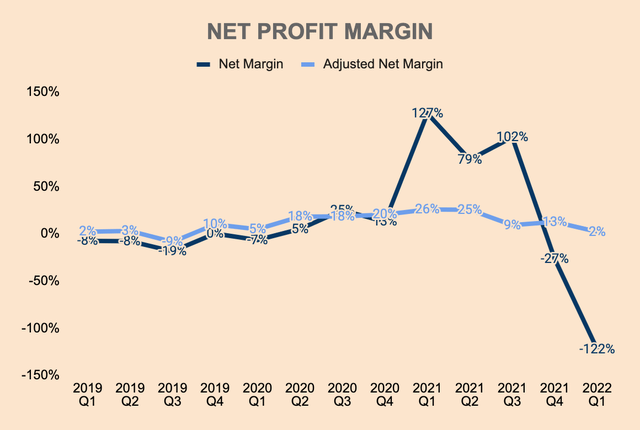

Turning to its bottom line, we can see the GAAP Net Margin is quite distorted due to its equity investments in Affirm and Global-e. On a Non-GAAP basis, Net Margin is at 2% as of Q1.

Source: Shopify Investor Relations and Author’s Analysis

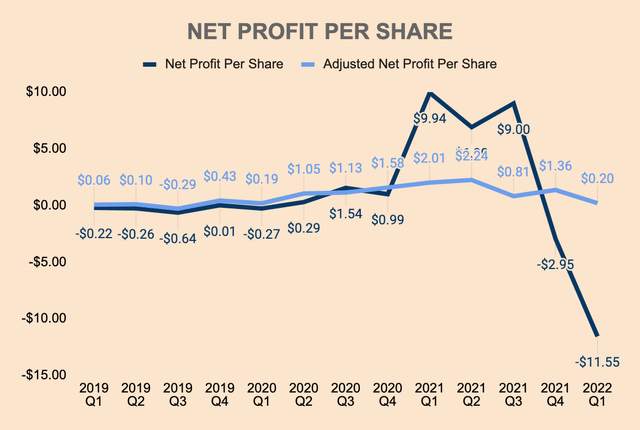

The same goes for Net Profit per Share – investors are better off focusing on the Non-GAAP metric, which is gradually improving over time. Net Profit Per Share swung to a massive loss in Q1 due to Affirm and Global-e stocks selling off by 50%+ in Q1.

Source: Shopify Investor Relations and Author’s Analysis

To summarize, Shopify has a moderately high Gross Margin profile, although it is likely to continue trending downwards as MS Revenue continues to outpace SS Revenue growth. There is no real evidence of economies of scale or operating leverage as the company continues to reinvest into growth. However, these reinvestments should pay off in the long run and we should see profitability metrics improve meaningfully over time.

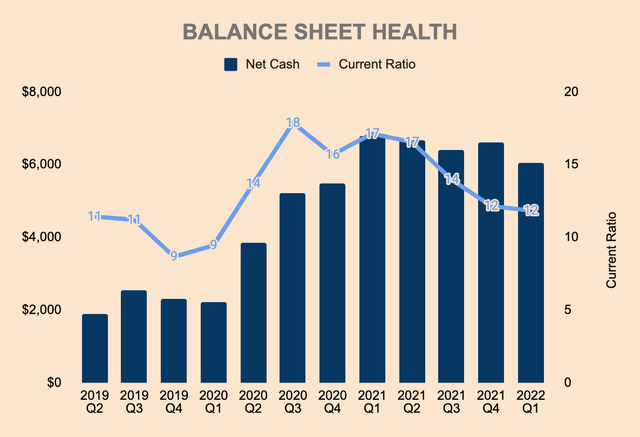

Financial Health

Turning to the balance sheet, Shopify has a very strong balance sheet with $7.2 billion in Cash & Short-Term Investments. The company has total debt of $1.2 billion, which puts its net cash position at $6 billion. The company also has a Current Ratio of 12x, which shows high liquidity.

Source: Shopify Investor Relations and Author’s Analysis

Most of its operations have been funded by external funding. The most recent capital raises were:

- February 2021 Issuance of 1.2 million shares at $1,315 per share – Gross proceeds of $1.6 billion.

- September 2020 Issuance of 1.1 million shares at $900 per share and convertible senior notes due 2025 – Gross proceeds of $2.0 billion.

- May 2020 Issuance of 2.1 million shares at $700 per share – Gross proceeds of $1.5 billion.

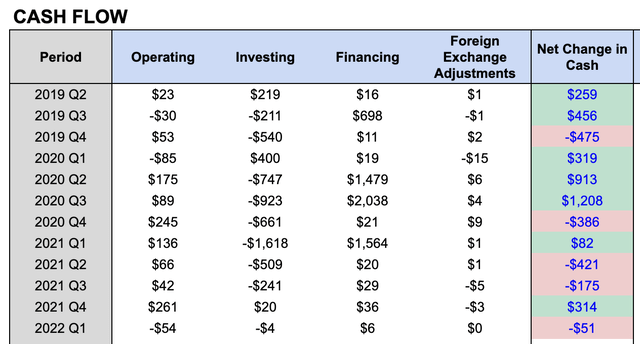

Shopify became Operating cash flow negative in Q1 as the company reinvests into growth. Cash used for Investing is mostly allocated for the purchase of marketable securities and equity investments.

Source: Shopify Investor Relations and Author’s Analysis

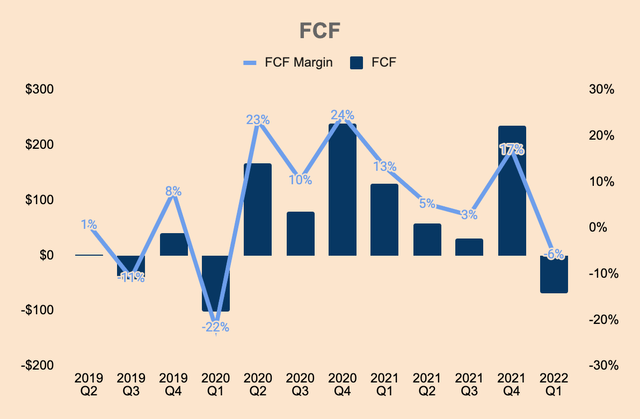

Free Cash Flow has been positive for the better part of 2020 and 2021 but is likely to compress or stay negative in the next few quarters as the company increases capital expenditures to strengthen its Shopify Fulfillment Network offering. Here’s CFO Amy Shapero explaining further during the Q4 earnings call:

CapEx related to Shopify Fulfillment Network will start to ramp in 2022, with an expectation for 2023 and 2024 of approximately $1 billion in capital expenditures over those 2 years for self-operated leased warehouse hubs in key U.S. geographies.

Source: Shopify Investor Relations and Author’s Analysis

Outlook

In terms of outlook, management did not provide any numerical guidance. Instead, management provided the following outlook:

- YoY Revenue growth to be lower in H1 and highest in Q4 of 2022.

- SS Revenue growth to be driven by merchant net adds.

- MS Revenue growth to be more than twice the rate of SS Revenue growth.

- Gross Profit growth will trail Revenue growth due to SS-MS Revenue mix.

- Capital Expenditures of $200 million.

- Stock-based compensation expenses and related payroll taxes of $800 million.

These observations are due to tough YoY comps in H1 as a result of:

- Lockdowns and government stimulus in H1 2021

- Changes in Revenue share agreement with app developers which was not in place in H1 2021

- Current investments to gain momentum in the back half of 2022.

Operating Margins are also expected to be negative as management intends “to reinvest all of our gross profit dollars back into the business to pursue our multiple paths to growth”.

As such, we may likely see a weak Q2 followed by strong growth in the back half of the year as YoY comps ease and investments in the business begin to gain traction.

Competitive Moats

Based on my research and analysis, I identified four competitive moats for Shopify: technology, scale, network effects, and switching costs.

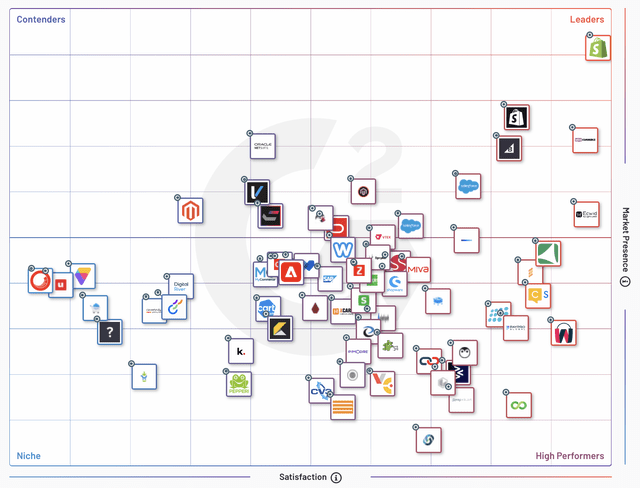

Technology

I believe Shopify is the go-to online store builder for entrepreneurs to build, manage, and grow their online stores. People choose the Shopify platform as it is designed for high security, scalability, reliability, and performance. As you can see from the chart below, G2 recognizes Shopify as the undisputed leader in the e-commerce platform category. There are many other competitors including BigCommerce (BIGC), Squarespace (SQSP), Wix (WIX), Weebly by Block (SQ), and Magento by Adobe (ADBE), but Shopify is way ahead of the pack. This speaks volumes about the technological prowess of the company.

Source: G2

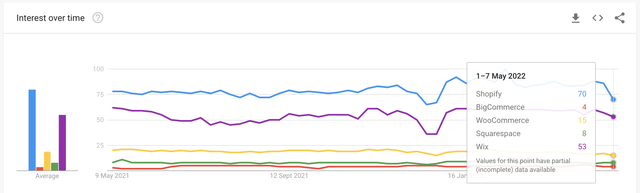

Furthermore, Shopify is the most searched e-commerce solution, as shown by the Google Trends chart below. This tells us that not only are Shopify’s solutions better but also that it has a strong brand.

Source: Google Trends

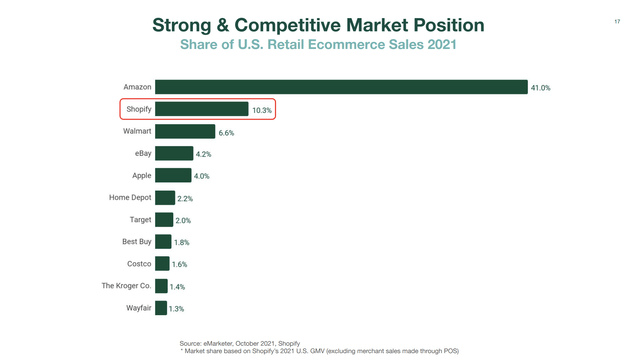

Scale

As of this writing, BuiltWith claims that there are 3,747,956 live websites powered by Shopify. Shopify also has the second-highest share of US e-commerce sales in 2021, behind none other than the great Amazon (AMZN).

Source: Shopify FY2021 Q4 Investor Presentation

In fact, Shopify’s scale is formidable. The company has 2 million+ merchants across 175+ countries. This merchant base includes 14,000+ Shopify Plus merchants such as Allbirds (BIRD), Heinz (KHC), FIGS (FIGS), Netflix (NFLX), Gymshark, NOBULL, and more.

This should lead to economies of scale and operating leverage as the company scales further. Furthermore, merchants would likely prefer a platform that is designed for scale.

Network Effects

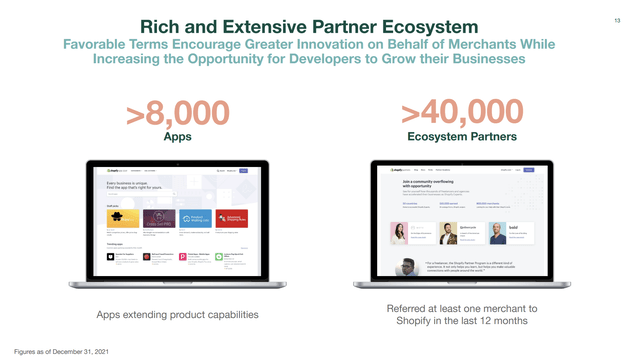

With its tremendous scale, Shopify is set up to enjoy powerful network effects as its ecosystem – which consists of merchants, customers, app developers, theme designers, and other partners – grows by the day.

Its partner ecosystem alone comprises more than 40,000 partners, developing a total of over 8,000 apps. These apps allow for easy integrations as well as help merchants accelerate their growth. A great example is its recent launch of the Shopify Global ERP program, which allows certain enterprise resource planning providers like Microsoft (MSFT), Oracle NetSuite (ORCL), Infor, Acumatica, and Brightpearl to build direct integrations into Shopify, specifically for high-volume merchants.

Source: Shopify FY2021 Q4 Investor Presentation

To foster further app and theme development, Shopify also updated its Revenue sharing agreement with developers. More specifically, Revenue share on the first $1 million in a calendar year will be reduced to $0. Once the $1 million threshold is passed, Shopify will then begin charging developers 15% on subsequent revenue. This way, developers are more inclined to develop Shopify-specific apps and themes, thus reinforcing the platform ecosystem.

As mentioned earlier, Shopify has partnered with various media companies that could amplify network effects. Here are some of the developments mentioned in its annual report:

- 2021 Q4 – Shopify launched the Spotify channel, enabling artist-entrepreneurs on Spotify to connect their Spotify for Artists accounts with their Shopify online stores, where they can sync their product catalogues and seamlessly showcase products directly on their Spotify profile.

- 2021 Q3 – Shopify introduced TikTok Shopping to merchants, enabling merchants with a TikTok For Business account to add products that link directly to their online store checkout.

- 2021 Q2 – Shopify announced that Shop Pay will become available to all merchants selling in the United States on Facebook and Google, even if they don’t use Shopify’s online store.

- 2020 Q4 – Shopify launched the TikTok channel, enabling merchants to market their products using TikTok for Business. Merchants are able to create in-feed video ads that autoplay between videos while users scroll through their For You page.

- 2020 Q2 – Shopify introduced the Facebook Shops channel, enabling Shopify merchants to customize and merchandise their storefronts within Facebook and Instagram through Facebook Shops, while managing their products, inventory orders, and fulfillment directly within Shopify.

Switching Costs

Shopify offers the internet infrastructure for merchants, characterized by a multi-channel frontend as well as a single integrated backend. In other words, Shopify acts as the backbone, the foundation, for businesses to operate an online store. It will be very difficult to replace the very foundation that has been built within a merchant’s business.

It is akin to buildings. Once construction is complete, it is almost impossible to replace its underlying structure. In fact, the building would need to be bulldozed and start building again from scratch.

In the case of online stores, switching out of Shopify’s platform means that merchants have to re-platform, which usually involves a steep learning curve, unnecessary expenditures, and precious time wasted.

That said, once a merchant uses Shopify and is satisfied with the platform, they are more inclined to stay within the platform. And as merchants grow, they inevitably opt-in for more advanced features (such as upgrading their subscription plans from Advanced Shopify to Shopify Plus). As merchants invest more in the platform, switching costs get even higher.

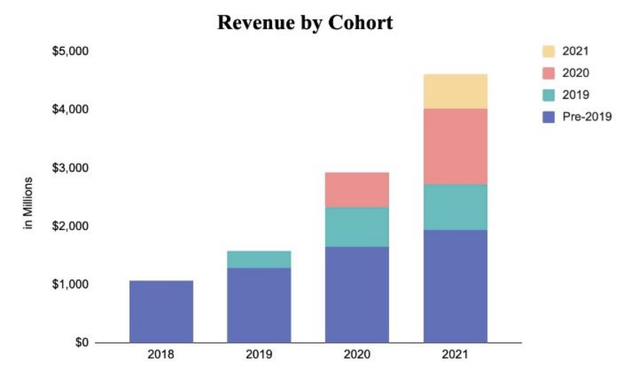

For example, as shown in the chart below, pre-2019 cohort Revenue expanded each year due to two reasons: 1) merchants who stay on the platform spend more and 2) merchants who spend more have higher retention rates. Pre-2019 cohort Revenue increased annually despite some merchants leaving the platform. That is the power of high switching costs.

Source: Shopify FY2021 Annual Report

Valuation

The markets are relentless these days, punishing stock after stock for missing estimates or guidance. That is what happened to Shopify when the company released Q1 results that fall short of analyst expectations. As a result, the stock plummeted by 15% to a new 52-week low. From its all-time highs, Shopify is down by 75%, and the company may head lower in the short term due to negative market sentiment and a slowdown in growth.

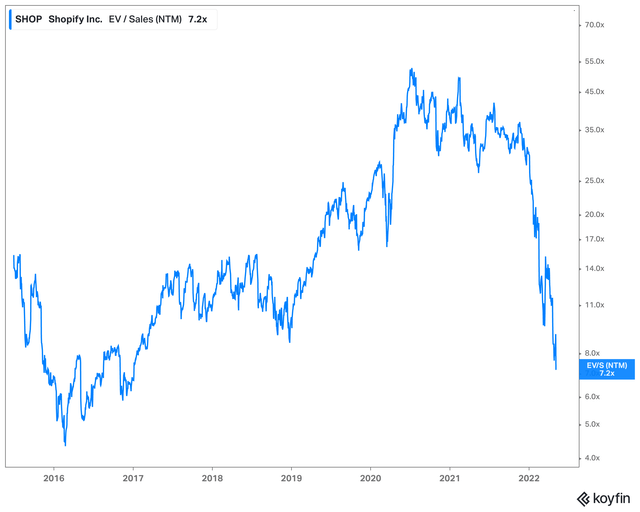

In terms of EV / NTM Sales, Shopify trades at a multiple of 7.2x, well below its March 2020 crash lows. It is also close to its 2016 lows of 4.4x. Despite being a much larger business, Shopify is valued close to its lowest valuation multiples ever. However, we can all agree that this re-rating is due to the company’s sharp deceleration of growth. We may even see Shopify trade at a multiple of 5.0x as the low-margin MS segment continues to outpace the growth of its high-margin SS segment.

Source: Koyfin

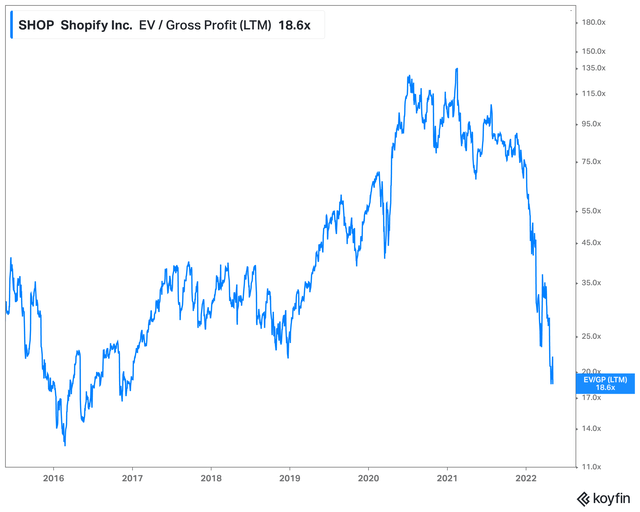

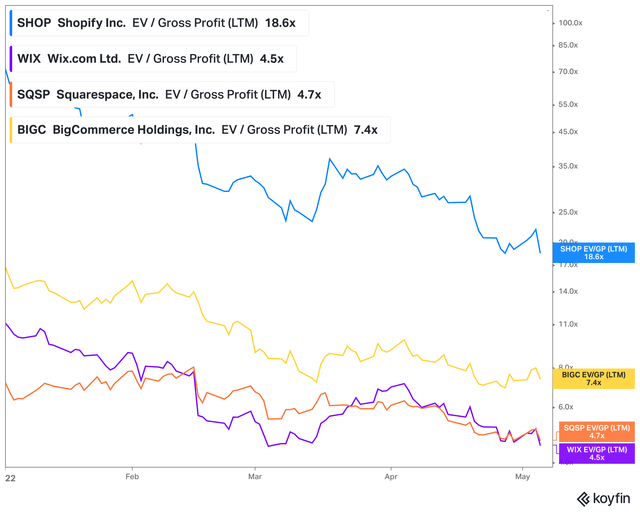

Considering its weakening margin profile, I think it’s more appropriate to use EV / Gross Profit multiples. Today, Shopify trades at 18.6x. Which is neither cheap nor expensive, even after the 75% valuation cut.

Source: Koyfin

It gets worse when we compare its valuation to peers, which are trading at much cheaper valuations. Of course, Shopify is a much higher quality business with higher expected growth rates, and thus, deserves a higher valuation multiple. Even so, the overvaluation relative to peers is worth considering.

Source: Koyfin

As such, I am quite mixed in terms of Shopify’s valuation. Despite Shopify trading close to its lowest valuation multiples ever, I’d like a better margin of safety considering a worsening macroeconomic environment, slowdown in growth, and uncertainty in terms of scaling Shopify Fulfillment Network.

Catalysts

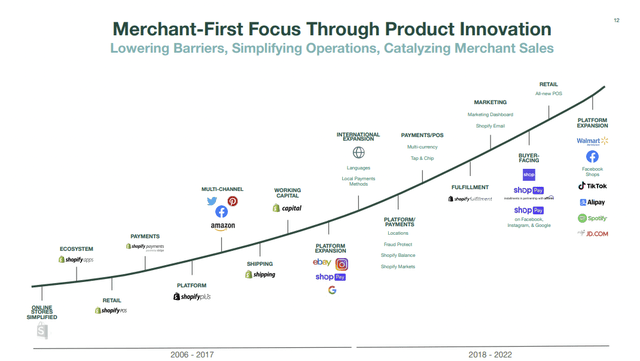

Product Innovation

Shopify has tons of optionality. Launching new products and services will expand the use case for Shopify’s platform, thus attracting more merchants across different geographies, sectors, and sizes. Not only that, but the more products or services merchants incorporate into their businesses, the higher the switching costs and the tighter the ecosystem gets.

Source: Shopify FY2021 Q4 Investor Presentation

Metaverse

With all the excitement around virtual reality, Shopify could introduce virtual shopping on its platform. For example, Shopify could launch a virtual mall that enables participating merchants to set up shop in the virtual world. Perhaps, Shopify could partner with Meta’s Oculus to enhance the shopping experience. Perhaps, Shopify could partner with Roblox (RBLX) to allow merchants to set up shop in a game. Perhaps, Shopify could partner with Matterport (MTTR) to enable merchants to upload virtual 3D stores on their respective websites.

Cross-border Commerce

In September last year, Shopify launched Shopify Markets to simplify cross-border commerce for merchants. In addition, Shopify announced its partnership with JD.com (JD) in January this year, which allows merchants to list their products on the JD Worldwide platform for cross-border e-commerce, more specifically, in China. The opportunity for cross-border commerce is large, especially in China, so this development should be a tailwind for Shopify. Here’s President Harley Finkelstein explaining further during the company’s Q4 earnings call:

China’s e-commerce market is estimated to be worth $3.3 trillion by 2025. That is 5x larger than the U.S. market. This channel integration opens up the China market to our merchants who can now reach JD’s 550 million active users. This enables our merchants to start selling quickly, while providing end-to-end fulfillment from JD’s U.S. warehouses directly to consumers in China. It also provides them smart price conversion to local currency based on foreign exchange rates and intelligent translation of product names and descriptions. This integration removes barriers to one of the most important e-commerce markets and is a major step in solving cross-border commerce for our merchants.

Shopify Fulfillment Network

Shopify launched SFN in 2019. It also acquired 6 River Systems for $450 million, in order to accelerate its SFN efforts. More recently, Shopify also announced to acquire Deliverr, an e-commerce fulfillment company, for $2.1 billion. Shopify’s fulfillment solution has yet to gain meaningful traction so investors should keep an eye on this department as it can solidify Shopify’s value proposition in terms of being a vertically-integrated e-commerce platform.

Stock Split

In April this year, Shopify announced a 10-for-1 stock split, set to take effect on June 28 this year. We may see shares rally a bit as they may be perceived as “cheaper” by the markets.

Risks

Global Recession

The global economy seems very fragile at the moment with raging inflation, interest rate hikes, and supply chain constraints. Shopify’s merchant base is predominantly small and medium businesses. A global recession is a big risk as most of Shopify’s customers are SMBs that may or may not have the financial resources necessary to survive an economic downturn.

Amazon

Competition is always a risk, especially when Amazon, the big bad wolf, is involved. For example, Amazon has partnered with two of Shopify’s competitors, Wix and BigCommerce, to enable their merchants to tap into Amazon’s Multi-Channel Fulfillment network. Furthermore, Amazon recently launched Buy with Prime:

Buy with Prime will allow millions of U.S.-based Prime members to shop directly from merchants’ online stores with the trusted experience they expect from Amazon-including fast, free delivery, a seamless checkout experience, and free returns on eligible orders. Prime members will see the Prime logo and delivery promise on eligible products in merchants’ online stores, which signals the item is available for free delivery, as fast as next day, with free returns. When shopping with Buy with Prime, checkout is simple and convenient. Prime members will use the payment and shipping information stored in their Amazon account and receive timely shipping and delivery notifications after an order is placed.

Thus, merchants may choose Wix or BigCommerce instead of Shopify, due to the incredible value propositions of Amazon’s fulfillment network (vs. Shopify Fulfillment Network) and Buy with Prime (vs. Shop Pay). Ben Thompson made a good observation based on these recent developments by Amazon and what it means for SFN:

What is worth noting, though, is that every transaction that Amazon processes is one not processed by Shopify, which again, is the company’s primary revenue driver. Moreover, the more volume that Amazon processes, the more difficult it will be for Shopify to get their own shipping solution to scale. This endangers the company’s current major initiative.

While Buy with Prime is perceived as a threat by most investors, Tobi Lutke sees things differently:

So we are actually thrilled with Amazon making a decision to take the amazing infrastructure that they’ve built because they have a second to none infrastructure and want to share this broadly with small merchants across the Internet. And so we are happy to integrate this into Shopify, just in the same way how we integrated what-the infrastructure that Meta built, the infrastructure that Google built and the infrastructure that TikTok built and so on. So this fits perfectly into our build view. And it’s not nearly as some people make it out to be. Whatever is good for merchants is — that will cause more entrepreneurship, which is exactly helps the vision of a company.

And from a business perspective, again, the more channel that exists that are valuable for selling, the more important Shopify tools has become because managing this is a task of significant complexity and software integration can tame that complexity and create a cohesive view into the business and again, make it much more possible for small businesses to engage in very complex retail strategies that previously you would have to-you would need a lot of headcount for. So this is all — this is actually really good news from our perspective.

WordPress

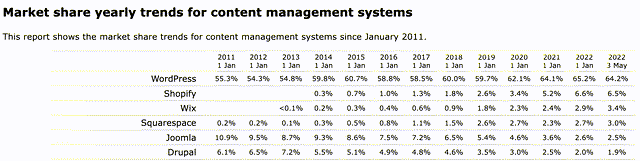

In the content management systems category, Shopify only has a 6.5% market share as of May 2022, according to W3Techs. This pales in comparison to WordPress, which has a 64.2% market share. However, do note that Shopify is specialized in e-commerce while WordPress caters to all types of websites, therefore, it may not be an apples-to-apples comparison. Nonetheless, it is worth noting that WordPress has a substantial presence in terms of websites built with it. In addition, it owns WooCommerce, which is a plug-in to specifically help WordPress users set up an online store.

Despite the vast market share differences, I want to direct your attention to Shopify’s market share growth over the last few years. Since 2014, Shopify’s market share grew the most and the fastest, which tells us that the company is scaling rapidly. In addition, it only has a 6.5% market share, opening the door for significant market share expansion.

Source: W3Techs

Conclusion

Shopify is building the infrastructure for the internet. It is a vertically-integrated e-commerce platform that supports a multi-channel frontend as well as a single integrated backend. The company is growing day by day and it has strong technology, scale, network effects, and switching costs moats. It has a long growth runway ahead as the world undergoes digital transformation.

While shares look cheap after the 75% selloff, we may see further downside as investors digest the slower revenue growth coupled with a challenging macroeconomic backdrop. The company is also turning unprofitable again which is not loved by many, especially in this kind of market environment. For me though, I like that management is investing back into the business, which should pay off in the long run.

As for its valuation, I have mixed feelings. But Shopify is a high-quality business with strong fundamentals and a long growth runway ahead. As such, I’ll be looking to buy into market weakness, or shop the drops, so to speak.

Thank you for reading my Shopify deep dive. If you enjoyed the article, please let me know in the comment section down below.